Legal Considerations in Debtor Finance Agreements: What Should Business Owners Be Aware Of?

When you're running a business, maintaining a healthy cash flow is key to driving growth. For many businesses, debtor finance is an essential tool to access immediate cash by borrowing against unpaid invoices.

How Debtor Finance Can Help Small and Medium Businesses Grow

When it comes to maintaining cash flow, small and medium-sized businesses (SMBs) face a unique set of challenges. For many business owners, the struggle to balance operational costs with income can limit growth. Fortunately, debtor finance offers a solution to SMBs.

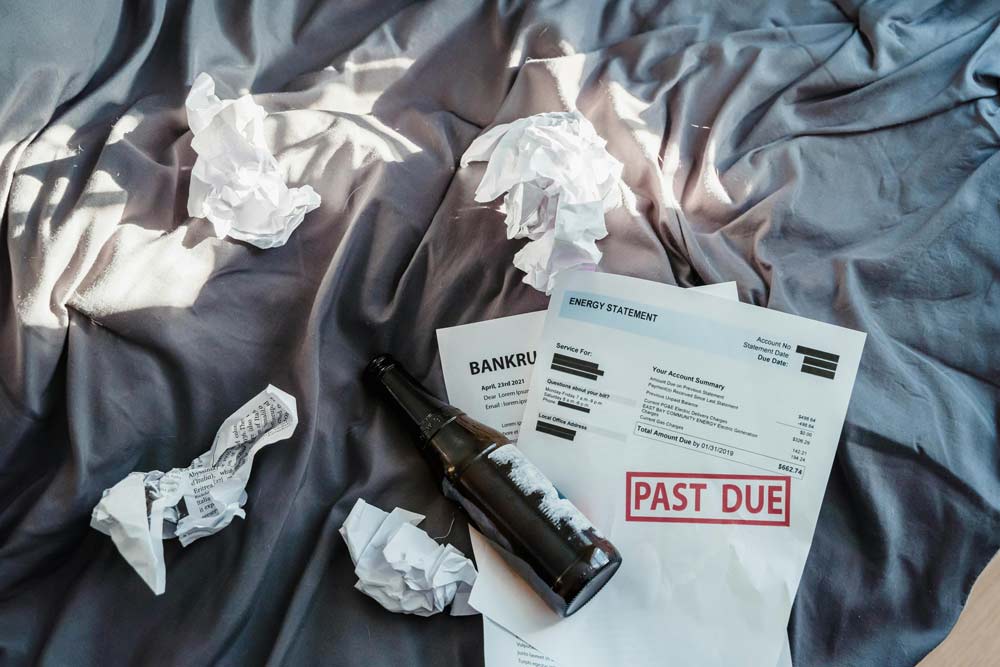

How Debtor Finance Can Be a Solution During Economic Downturns

During economic downturns, cash flow issues are a significant concern for businesses. Even established companies can face difficulties managing day-to-day operations.

Invoice Factoring vs Invoice Discounting: Which Debtor Finance Option Is Right for Your Business?

Delayed payments can create a serious cash flow crunch, especially for small to medium-sized businesses.

What Is Debtor Finance? A Comprehensive Guide for Business Owners

Cash flow is the lifeblood of any business. But let’s be honest—waiting for clients to pay their invoices can feel like watching paint dry.